What Happens to the Housing Market During a Recession? Here’s What the Data Says

Lately, there’s been a lot of talk about a potential recession and what it might mean for the economy, especially the housing market. If you’re a homeowner, a buyer, or just real estate-curious, it’s completely normal to have questions right now. Will home prices fall? Will mortgage rates skyrocket? Is this a good time to buy or sell?

Let’s cut through the noise and look at what the data actually tells us. You might be surprised by what we find.

Recession Doesn’t Mean Housing Crash

First off, not all recessions are created equal—and not all of them lead to a housing market crash. In fact, the housing market tends to behave differently than the stock market during economic downturns. According to CoreLogic, during most recent recessions, home prices have either stayed steady or continued to rise.

Why? A few reasons:

1. Housing is a basic need—people still need places to live.

2. Inventory is usually tight during recessions, which helps support prices.

3. Long-term buyers tend to stay the course, especially with low fixed rates.

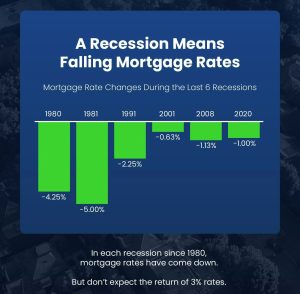

Mortgage Rates Often Go Down

Here’s something else that might surprise you: mortgage rates tend to fall during a recession. According to historical data from Freddie Mac, interest rates often drop as the Federal Reserve tries to stimulate the economy. Lower rates can make buying a home more affordable—even if economic conditions are uncertain.

That means recessions can actually be a window of opportunity for homebuyers looking to lock in a great rate. And for sellers, it means more motivated buyers might still be in the market.

Looking at the Numbers

Let’s take a look at the big picture. According to CoreLogic, during the last six recessions, home prices appreciated in four and only declined during the Great Recession and the one in the early ’90s. Even in those cases, declines were more moderate compared to other financial indicators.

You can explore more here:

- Freddie Mac Mortgage Rate Data

- Mortgage Specialists – Recession & Real Estate

- CoreLogic Blog on Housing Recessions

- History of Recessions in the U.S.

- CoreLogic HPI 2021 Growth

The Bottom Line

Recession fears can be overwhelming, especially when it comes to big decisions like buying or selling a home. But the data tells a more encouraging story. Historically, home values have held strong, and mortgage rates have often dipped—offering opportunities for savvy buyers and steady footing for sellers.

If you’re considering a move, I’m here to help you navigate the market with clarity and confidence. Let’s talk about your goals and what makes the most sense for you in today’s landscape.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link